- 617.00 KB

- 2022-05-26 16:46:15 发布

- 1、本文档共5页,可阅读全部内容。

- 2、本文档内容版权归属内容提供方,所产生的收益全部归内容提供方所有。如果您对本文有版权争议,可选择认领,认领后既往收益都归您。

- 3、本文档由用户上传,本站不保证质量和数量令人满意,可能有诸多瑕疵,付费之前,请仔细先通过免费阅读内容等途径辨别内容交易风险。如存在严重挂羊头卖狗肉之情形,可联系本站下载客服投诉处理。

- 文档侵权举报电话:19940600175。

国际商务——希尔英文PPT19

IntroductionAccountingisthelanguageofbusiness–itisthewayfirmscommunicatetheirfinancialpositionsAccountingstandardsdifferfromcountrytocountryThesedifferencesmakeitdifficultforinvestors,creditors,andgovernmentstoevaluatefirmsTheInternationalAccountingStandardsBoard(IASB)hasmadesomeattemptstoestablishcommonaccountingandauditingstandardsacrosscountries

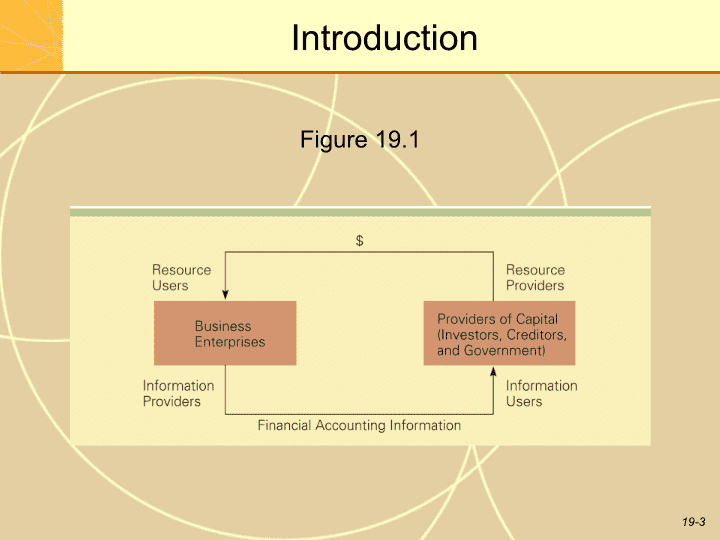

IntroductionFigure19.1

CountryDifferencesIn

AccountingStandardsAcountry’saccountingsystemevolvesinresponsetolocaldemandsforaccountinginformationWhiletherehavebeeneffortstoharmonizeaccountingpracticesacrosscountries,significantdifferencesremainOnestudyfoundthatamong22countries,therewere76waystoassessthecostofgoodssold,65differencesinthecalculationofreturnonassets,and20waystocalculatenetprofitsThedifferencesmakeitchallengestocomparefinancialperformanceoffirmsfromdifferentcountries

CountryDifferencesIn

AccountingStandardsFivemainvariablesinfluencethedevelopmentofacountry’saccountingsystem:1.therelationshipbetweenbusinessandtheprovidersofcapital2.politicalandeconomictieswithothercountries3.thelevelofinflation4.thelevelofacountry’seconomicdevelopment5.theprevailingcultureinacountry

CountryDifferencesIn

AccountingStandardsFigure19.2

RelationshipBetweenBusiness

AndProvidersOfCapitalThethreemainexternalsourcesofcapitalforfirmsare:IndividualinvestorsBanksGovernmentAcountry’saccountingsystemreflectstherelativeimportanceofeachconstituencyasaproviderofcapitalSo,accountingsystemsintheU.S.andGreatBritainareorientedtowardindividualinvestors;Switzerland,Germany,andJapanfocusonprovidinginformationtobanks;andFranceandSwedenpreparefinancialdocumentswiththegovernmentinmind

ClassroomPerformanceSystem_______hasanaccountingsystemthatwasdevelopedwiththegovernmentinmind.a)Franceb)Japanc)GreatBritaind)Germany

PoliticalAndEconomic

TiesWithOtherNationsSimilaritiesinaccountingsystemsacrosscountriescanreflectpoliticaloreconomictiesTheU.S.accountingsysteminfluencesthesystemsinCanadaandMexicoIntheEuropeanUnion,countriesaremovingtowardcommonstandards

InflationAccountingThehistoriccostprincipalassumesthecurrencyunitusedtoreportfinancialresultsisnotlosingitsvalueduetoinflationThisprincipleaffectsassetvaluationIfinflationishigh,assetswillbeundervalued

LevelOfDevelopmentDevelopednationstendtohavemoresophisticatedaccountingsystemsthandevelopingcountriesManydevelopingnationshaveaccountingsystemsthatwereinheritedfromformercolonialpowers

CultureTheextenttowhichacultureischaracterizedbyuncertaintyavoidance(theextenttowhichculturessocializetheirmemberstoacceptambiguoussituationsandtolerateuncertainty)impactsthecountry’saccountingsystemCountrieswithlowuncertaintyavoidancecultureshavestrongindependentauditingprofessions

NationalAndInternationalStandardsAccountingstandardsarerulesforpreparingfinancialstatements—theydefineusefulaccountinginformationAuditingstandardsspecifytherulesforperforminganaudit—thetechnicalprocessbywhichanindependentpersongathersevidencefordeterminingiffinancialaccountsconformtorequiredaccountingstandardsandiftheyarealsoreliable

LackOfComparabilityBecauseofnationaldifferencesinaccountingandauditingstandards,comparabilityoffinancialreportsfromonecountrytoanotherisdifficultThegrowthoftransnationalfinancingandtransnationalinvestmentispromotingthegrowthoftransnationalfinancialreporting

InternationalStandardsTherehasbeenasubstantialeffortrecentlytoharmonizeaccountingstandardsacrosscountriesManycompaniesobtaincapitalfromforeignproviderswhoaredemandinggreaterconsistencyCommonaccountingstandardswillfacilitatethedevelopmentofglobalcapitalmarketsTheInternationalAccountingStandardsBoard(IASB)isamajorproponentofstandardizationTheIASBcurrentlyhas45standards,butcomplianceisvoluntaryAbout100nationshaveadoptedIASBstandardsorpermittedtheiruseinreportingfinancialresults

ClassroomPerformanceSystemWhichorganizationisresponsibleforformulatinginternationalaccountingstandards?theGlobalFederationofAccountantstheWorldBanktheInternationalAccountingStandardsBoardtheInternationalPanelofAccountingStandardsandEthics

ClassroomPerformanceSystemTheIASBcurrentlyhasabout____standards.a)10b)25c)45d)95

InternationalStandardsMostIASBstandardsareconsistentwithstandardsalreadyinplaceintheUnitedStatesTheEuropeanUnionhasmandatedharmonizationofaccountingprinciplesinitsmembercountriesBy2010,therecouldbeonlytwomajoraccountingbodieswithsubstantialinfluenceonglobalreporting–FASBintheUnitedStatesandIASBelsewhere

ClassroomPerformanceSystemBy2010,whichtwoaccountingbodiesareexpectedtodominateaccountingpractices?a)ThehistoriccostprincipleandFSABb)FSABandtheIASBc)TheIASBandthehistoriccostprincipled)Thecurrentratemethodandthehistoriccostprinciple

MultinationalConsolidation

AndCurrencyTranslationAconsolidatedfinancialstatementcombinestheseparatefinancialstatementsoftwoormorecompaniestoyieldasinglesetoffinancialstatementsasiftheindividualcompanieswerereallyoneMultinationalfirmstypicallyissueconsolidatedfinancialstatements

ConsolidatedFinancialStatementsThetypicalmultinationalcompanyismadeupofaparentcompanyandanumberofsubsidiarycompaniesEconomically,allthecompaniesareinterdependentTheconsolidatedfinancialstatementprovidesaccountinginformationaboutthegroupofcompaniesTransactionsamongmembersofacorporatefamilyarenotincludedinconsolidatedfinancialstatements,however,becauseseparatelegalentitiesarerequiredtokeeptheirownaccountingrecordstheyrecordtransactionswithothermembersofthecorporatefamilyinseparatestatementsTheIASBrequiresfirmstoprepareconsolidatedfinancialstatements,asdomostindustrializednations

CurrencyTranslationForeignsubsidiariesusuallykeepaccountingrecordsandpreparefinancialstatementsinthelocalcurrencyToprepareconsolidatedfinancialstatements,alllocalfinancialstatementsmustbeconvertedtothehomecurrencyTherearetwomethodstodeterminewhatexchangerateshouldbeusedwhentranslatingfinancialstatementcurrencies:1.thecurrentratemethod2.thetemporalmethod

TheCurrentRateMethodUnderthecurrentratemethod,theexchangerateatthebalancesheetdateisusedtotranslatethefinancialstatementsofaforeignsubsidiaryintothehomecurrencyofthemultinationalfirmThecurrentratemethodisincompatiblewiththehistoriccostprinciple

TheTemporalMethodThetemporalmethodtranslatesassetsvaluedinaforeigncurrencyintothehomecurrencyusingtheexchangeratethatexistswhenassetsarepurchasedSo,whilethetemporalmethodavoidstheproblemsassociatedwiththecurrentratemethod,itisstillproblematicbecausedifferentexchangeratesareusedtotranslateforeignassets

CurrentU.S.PracticeU.S.multinationalsarerequiredtofollowFASB52whichstates:thefunctionalcurrencyisthelocalcurrencyofeachself-sustainingforeignsubsidiarybalancesheetsshouldbetranslatedintothehomecurrencyusingtheexchangerateineffectattheendofthefirm’sfinancialyearincomestatementsaretranslatedusingtheaverageexchangerateforthefirm’sfinancialyear

ClassroomPerformanceSystemWhenafirmusestheexchangerateatthebalancesheetdatetotranslatefinancialstatementsofaforeignsubsidiaryintothehomecurrency,thefirmisusinga)thetemporalmethodb)thecurrentratemethodc)FASB52d)thehistoriccostprinciple

ClassroomPerformanceSystemFinancialstatementsofU.S.firmsmustbepreparedaccordingtoa)FASBb)IASBc)IFACd)EUAC

AccountingAspectsOfControlSystemsThecontrolprocessinmostfirmsisusuallyconductedannuallyandinvolvesthreesteps:1.subunitgoalsarejointlydeterminedbytheheadofficeandsubunitmanagement2.theheadofficemonitorssubunitperformancethroughouttheyear3.theheadofficeintervenesifthesubsidiaryfailstoachieveitsgoal,andtakescorrectiveactionsifnecessaryTwofactorsthatcancomplicatethecontrolprocessareexchangeratechangesandtransferpricingpractices

ExchangeRateChanges

AndControlSystemsMostinternationalfirmsrequirebudgetsandperformancedatatobeexpressedinthecorporatecurrency-normallythehomecurrencyWhilethisfacilitatescomparisonsbetweensubsidiaries,itcanalsocreatedistortionsinfinancialstatements

TheLessard-LorangeModelDonaldLessardandPeterLorangesuggestthatfirmscandealwiththeproblemsofexchangeratesandcontrolinthreeways:1.theinitialrate-thespotexchangeratewhenthebudgetisadopted2.theprojectedrate-thespotexchangerateforecastfortheendsofthebudgetpicture3.theendingrate-thespotexchangeratewhenthebudgetandperformancearebeingcompared

TheLessard-LorangeModelFigure19.3

TheLessard-LorangeModelLorangeandLessardsuggestthatfirmsusetheprojectedspotexchangerate(usuallytheforwardexchangerate)totranslatebudgetandperformancefiguresintothecorporatecurrencyFirmscanalsousetheinternalforwardrate(company-generatedforecastoffuturespotrates)

TransferPricingAndControlSystemsThepriceatwhichgoodsandservicestransferredwithinthefirmisthetransferpriceThechoiceoftransferpricecansignificantlyinfluencetheperformanceofsubsidiariesTransferpricesshouldbeconsideredwhenevaluatingasubsidiary’sperformanceCompaniescanmanipulatetransferpricestominimizetaxliability,minimizeimportduties,andavoidgovernmentrestrictionsoncapitalflows

SeparationOfSubsidiary

AndManagerPerformanceTheevaluationofasubsidiaryshouldbekeptseparatefromtheevaluationofitsmanagerAmanager’sevaluationshouldconsiderthecountry’senvironmentforbusiness,andshouldtakeplaceaftermakingallowancesforthoseitemsoverwhichmanagershavenocontrol

此课件下载可自行编辑修改,仅供参考!

感谢您的支持,我们努力做得更好!谢谢