- 121.17 KB

- 2022-05-26 16:48:06 发布

- 1、本文档共5页,可阅读全部内容。

- 2、本文档内容版权归属内容提供方,所产生的收益全部归内容提供方所有。如果您对本文有版权争议,可选择认领,认领后既往收益都归您。

- 3、本文档由用户上传,本站不保证质量和数量令人满意,可能有诸多瑕疵,付费之前,请仔细先通过免费阅读内容等途径辨别内容交易风险。如存在严重挂羊头卖狗肉之情形,可联系本站下载客服投诉处理。

- 文档侵权举报电话:19940600175。

ProfitPoolsandCoreCompetenceDarralGClarkeProfessorofManagementTheMarriottSchoolBrighamYoungUniversity2021/12/151

ProfitPools:AFreshLookatStrategyOritGadieshandJamesL.GilbertHarvardBusinessReviewMay-June19982021/12/152

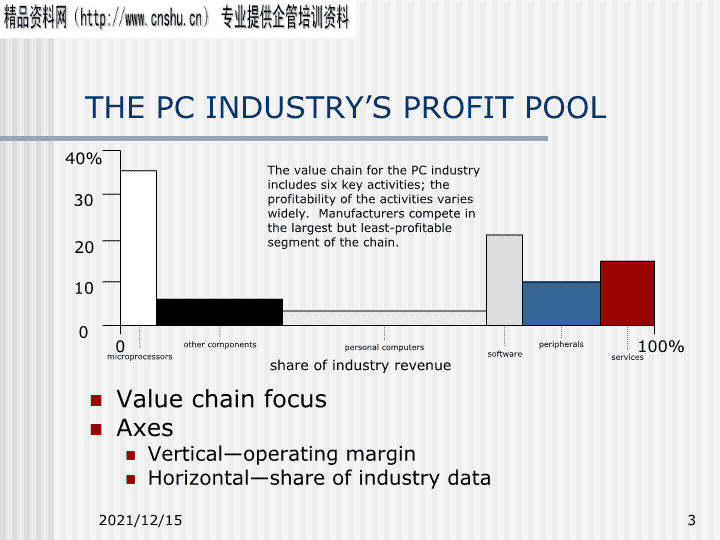

THEPCINDUSTRY’SPROFITPOOLValuechainfocusAxesVertical—operatingmarginHorizontal—shareofindustrydata40%30201000100%shareofindustryrevenuemicroprocessorsothercomponentspersonalcomputerssoftwareperipheralsservicesThevaluechainforthePCindustryincludessixkeyactivities;theprofitabilityoftheactivitiesvarieswidely.Manufacturerscompeteinthelargestbutleast-profitablesegmentofthechain.2021/12/153

TheProfitPoolLensTheprofitpoolisthetotalprofitearnedinanindustryatallpointsalongtheindustry’svaluechainSegmentprofitabilitymayvarybycustomergroup,productcategory,geographicmarket,ordistributionchannelProfitconcentrationmaybeverydifferentthanrevenueconcentrationShapeoftheprofitpoolreflectsthecompetitivedynamicsofabusinessInteractionsofcompaniesandcustomersCompetitivestrategiesofcompetitorsProductpoolsarenotstagnant2021/12/154

THEU.S.AUTOINDUSTRY’SPROFITPOOL100%operatingmarginsource:HarvardBusinessReview,May-June1998autorental25%1510500shareofindustryrevenueautomanufacturingnewcardealersusedcardealersautoloansautoinsuranceaftermarketparts20leasingwarrantygasolineservicerepairTheautomotiveindustryencompassesmanyvalue-chainactivities.Thewaythatprofitsandrevenuesaredistributedamongtheseactivitiesvariesgreatly.Themostprofitableareasofthecarbusinessarenottheonesthatgeneratethebiggestrevenues.2021/12/155

ProfitPools:CompanyExamplesCompaniesAutomakersU-HaulElevators(OTIS)HarleyDavidsonPolaroidCoreBusinessAutomanufacturingTruckRentalElevatorManufacturingMotorcyclesInstantPhotographyCamerasSourcesofHighestROIAutoleasing,insurancePackingmaterials,storageServiceAccessories(consumerproducts),leasing,service,restaurantsFilm2021/12/156

ManagerialImplicationsFocusongrowthandmarketsharecanleadacompanytofocusonunprofitablesegmentsofanindustryToday’sdeeprevenuerevenuepoolmaybetomorrow’sdryhole.ThegoalshouldbetofocusonprofitableopportunitiesIndustryshouldbeconsideredmorebroadlythantraditionaldefinitionAutomobileindustryincludesComponentmanufactureandsupplyNewcarassemblyanddeliveryNewcarwarranteeandserviceNewcarfinancingandinsuranceUsedcarsalesandservice2021/12/157

TurbulentindustriesProfitpoolsareespeciallyimportantandusefulinindustriesundergoingderegulationand/ortechnologicalchangeSuchchangescanopennewprofitpoolopportunitiesanddrainoldonesChokepointsmaychangeorbeeliminatedOpportunitiesforeitherforwardorverticalintegrationmayemergeCurrentverticalintegrationmaybedisintermediated2021/12/158

CreatingandmanagingaprofitpoolProfitpoolanalysismayindicatenewopportunitiesorthreatsImperativesBeopentoanewperspectiveonyourbusinessandindustryDevelopingnewstrategymayrequireoverturningelementsofthecurrentstrategyBeopentoreevaluatetheroleplayedbycurrentcompetitorsBevigilanttoidentifypossibilitythatnewentrantsmayseektoenteryourindustrywithradicalstrategies2021/12/159

LookingAhead:ProfitPoolsandtheFiveForcesProfitpoolsarecomputedbymultiplyingthesizeoftherevenuebytheunitprofitmarginEssentiallyanaccountingprocess--notheoryMostvaluableinsituationsinwhichexternalconditionsareessentialstableand/orunimportant(Oftendominatedbyinternaldataalone)Thefiveforcestellsus(whichwillstudynext)theunderlyingdeterminantsthatdetermineboththerevenuesizeandtheunitprofitmarginTheprofitdriverswhichallowustoforecastthedirectionofchange2021/12/1510

MarakonRunnersThomasA.StewartFortuneSept.28,19982021/12/1511

MarakonAssociates’sApproachtoCorporateStrategyConsultantstomanylargecorporationsCocaCola,HP,GM,CitiCorp,etc.Clientshavereturns3.1%higherthanindustrypeergroupGoalistoincreaseshareholdervaluethroughanalysisofeconomicprofitDeepdrillinginbusinessdatatomeasurevaluecreationProductsegmentsCustomersegments2021/12/1512

HowStrategyHappensLearningwherevalueiscreatedWaterfallchartsbyproductandcustomersegmentsEvaluatingstrategyIndustryaverageprofitperunitCompany’sprofitvsindustryaverageManagingvalueCurrentstrategyChangeproductfocusChangecustomerfocus2021/12/1513

LearningwherevalueiscreatedProductsegmentsCustomersegmentsProfit/loss($perunit)Volume(units)Volume(units)02021/12/1514

EvaluatingStrategyCompanyprofitperunitIndustry-averageprofitperunit2021/12/1515

ManagingforvalueCurrentstrategyChangeproductfocusChangeCustomerfocusValue2021/12/1516

ApplicationtoourcasesRetailindustry(Wal*Mart)Softdrinkindustry(Coca-ColaandPepsiCo)Steel(Nucor)andaluminumcans(CC&S)Hitech(Intel,Cisco,andDell)Videogames(Nintendo)Webbusinesses(eBayandYahoo!)2021/12/1517

TheCoreCompetenceoftheCorporationPrahalad,C.K.andGaryHamelHarvardBusinessReview,May-June19902021/12/1518

CoreCompetenceAFirmismadeupofresourcespeople,patents,brandnames,plant&equipment,processes,etcAcompetenceistheabilitytoemploydiverseskillsandresourcestoperformtasksandactivities.Acorecompetenceisabroadlybasedand/orabroadlyappliedfundamentalcapability.2021/12/1519

CompetenceandTechnologyCompetenceisnotthesameastechnologyCompetencerequirestechnologiessocialorganizationcollectivelearning2021/12/1520

Corecompetencequestions:Whatarewereallygoodat?Howcanwebuilduponit?Whatdoweneedtobegoodat?2021/12/1521

CharacteristicsofEffectiveCompetenciesDurability:Technicalequipmentcanbeshortlived.Reputationorknowledgemaydepreciatemoreslowly.Transparency:Themorecomplexthesourceofcompetence,theharderitistoimitateit.Transferability:Theavailabilityofresourcestocompetitors.Replicability:Acompetitor’sinternalabilitytoreplicateacompetenceusingavailableresources.2021/12/1522

ChoosingCompetenciesHowcentralisthiscompetencetooursuccessinthemarket?Howlongcouldwepreserveourcompetitivenessinthisbusinesswithoutthisparticularcompetence?Whatfutureopportunitieswouldbeforeclosedifweweretolosethisparticularcompetence?2021/12/1523

CoreCompetenceandCoreProducts2021/12/1524

AHierarchyofCompetencies2021/12/1525

BuildingStrategyfromCapabilitiesStrategyCapabilitiesResources1.Identifyresources,appraiserelativestrengthsandweaknesses.Leverageuseofresources2.Identifycapabilities.Whatdowedomoreeffectivelythancompetitors?Identifyresourceinputstocapabilities.3.Appraiserent-generatingpotentialresourcesandcapabilitiesintermsof:sustainableadvantage,inappropriability4.Selectstrategythatbestexploitsthefirm’sresourcesandcapabilitiesrela-tivetoexternalopportunities.5.Identifyresourcegapsthatneedtobefilled.Investinreplenishing,augmenting,andup-gradingthefirm’sresourcebase.CompetitiveAdvantageSource:RobertM.Grant,“TheResource-BasedTheoryofCompetitiveAdvantage,”CaliforniaManagementReview,Spring,1991,page151.2021/12/1526

Howtomapyourindustry’sprofitpoolOritGadieshandJamesL.GilbertHarvardBusinessReviewMay-June19982021/12/1527

AstraightforwardexercisewithcomplicationsConceptisstraightforwardDefinevaluechainactivitiesDeterminetheirsizeandprofitabilityApplicationofconceptiscomplicatedFinancialdatadoesn’tcorrespondtovaluechainactivitiesCompanydataisaggregatedacrossbusinessesProducts,customerpurchases,channelvolumesrarelymatchupwithboundariesofanactivityConsiderablecreativityisrequired2021/12/1528

FourstepprocessDefinethepoolDeterminethesizeofthepoolDeterminethedistributionofprofitsReconciletheestimates2021/12/1529

FourstepprocessDefinethepoolDeterminethesizeofthepoolDetermineprofitdistributionReconciletheestimatesTask:determinewhichvalue-chainactivityinfluenceprofitsnowandinthefutureDevelopabaselineestimateofcumulativeprofitsgeneratedbyallprofitpoolactivitiesDevelopestimateoftheprofitsgeneratedbyeachactivityComparetheoutputsofsteps2&3GuidelinesTakeabroadviewofthevaluechain(beyondtraditionalindustrydefinition)SeekaroughbutaccurateestimateShiftbetweenaggregationanddisaggregationinyouranalysisIfnumbersdon’taddup,CheckassumptionandcalculationsExamineindustryfromthreeperspective:own,otherplayers,customersTakeeasiestroute:gowherethedataareDoowneconomicsfirst,thenlargepureplayers,largemixed,smallerCollectadditionaldataDon’tdisaggregatemorethannecessaryTakeatleasttwoviewpoints:companylevelandproductlevelUseproxymeasureswherenecessaryResolveinconsistencies—don’tignorethemOutputProfitpoollistEstimateoftotalpoolprofits,(range)PointestimateofprofitsforeachvaluechainactivityFinalestimatesofactivityandtotalpoolprofits2021/12/1530

Whatis“profit”anyway?Canbethoughtofinthreeways(allofwhichmayberelevantforprofitpoolanalysis)AccountingprofitReturnoninvestmentEconomicvalueadded=after-taxoperatingprofits–costofallinvestedcapitalCash-flowEarningsbeforetakingfixed-assetandcapitalcostsintoaccount2021/12/1531

Example:CreditcardsatRegionBankAcquisitionFundingServicing$80valueofasubscriber$279averageannualrevenuespersubscriber$60annualpaymenttoservicerpersubscriber-$64costofacquiringasubscriber-$235averageannualcostspersubscriber$50averageannualcosttoservicer$16acquisitionprofitpersubscriber$44annualfundingprofitpersubscriber$10annualservicingprofitpersubscriber$3.20annualacquisitionprofitpersubscriberamortizedover5yearaveragelifeX260millionsubscribersX260X260$800millionprofit$11.4billionprofit$2.6billionprofit2021/12/1532

RegionBank’sProfitPoolMap100%acquisitionfundingservicingShareofindustryrevenue20%Operatingmargin2021/12/1533

RegionBank’sProfitPoolMosaicBanksShareofindustryprofitsacquisitionfundingservicingShareofactivityprofits100%100%BanksBanks2021/12/1534