- 551.53 KB

- 2022-05-26 16:46:23 发布

- 1、本文档共5页,可阅读全部内容。

- 2、本文档内容版权归属内容提供方,所产生的收益全部归内容提供方所有。如果您对本文有版权争议,可选择认领,认领后既往收益都归您。

- 3、本文档由用户上传,本站不保证质量和数量令人满意,可能有诸多瑕疵,付费之前,请仔细先通过免费阅读内容等途径辨别内容交易风险。如存在严重挂羊头卖狗肉之情形,可联系本站下载客服投诉处理。

- 文档侵权举报电话:19940600175。

CONTENTKeystrategicprinciplesRegulatoryoverviewMarketoverviewCompetitionoverviewBusinessmodelsNextsteps

AGENDABusinessModelsDomesticandinternationallong-distancevoiceWholesale/carrierEnterprisesolutionsIssuesgoingforward

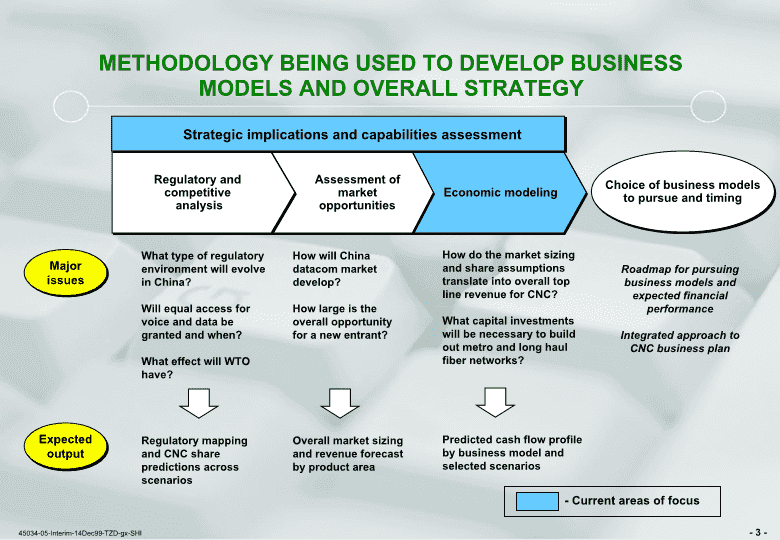

EconomicmodelingChoiceofbusinessmodelstopursueandtimingRoadmapforpursuingbusinessmodelsandexpectedfinancialperformanceIntegratedapproachtoCNCbusinessplanMajor

issuesExpected

outputHowdothemarketsizingandshareassumptionstranslateintooveralltoplinerevenueforCNC?Whatcapitalinvestmentswillbenecessarytobuildoutmetroandlonghaulfibernetworks?PredictedcashflowprofilebybusinessmodelandselectedscenariosAssessmentofmarketopportunitiesHowwillChinadatacommarketdevelop?Howlargeistheoverallopportunityforanewentrant?OverallmarketsizingandrevenueforecastbyproductareaRegulatoryandcompetitiveanalysisWhattypeofregulatoryenvironmentwillevolveinChina?Willequalaccessforvoiceanddatabegrantedandwhen?WhateffectwillWTOhave?RegulatorymappingandCNCsharepredictionsacrossscenariosStrategicimplicationsandcapabilitiesassessmentMETHODOLOGYBEINGUSEDTODEVELOPBUSINESSMODELSANDOVERALLSTRATEGY-Currentareasoffocus

CNCATACRITICALSTRATEGICCROSSROADSPreliminaryConclusionsRecommendations/DecisionstobeMadeOffnetVOIPpredictedtogeneratetoprovidebreakeveneconomicsforbuildingbackbone1WholesalerevenueprovidessignificantupsidepotentialMajorityofwholesalerevenuereliesonaccesstomobilecarriersEnterprisesolutionseconomicsveryattractive,butsubstantialcomplexityandresourcesinvolvedHigh-bandwidthinternationalgatewaycriticaltosuccessinbothwholesaleandenterpriseEconomicpredictionshighlysensitivetoasetofkeyassumptionsAcceleratevendorselectionandbackboneconstruction;timetomarketcriticalCommitmenttoutilizingIP/DWDMinvlolvesrisktomobilecarrierbusinessRFPtovendorsshouldbebasedonproductrequirementsvs.technologyStagingofinvestmentsandservicelaunchmustconsidertradeoffbetweenqualityofserviceandcoveragePreliminarytalkswithinternationalcarriersshouldbeginASAPScenariomodelingwillhelpusdecidewheretofocusOverarchingquestion:CanCNCsuccessfullypursueallopportunitiesoutlinedintheshort/mediumterm?(1)Assumingsettlementfeesof10%ofrevenue

OverallapproachWhereHowBUSINESSMODELSSUMMARY:THREECOREELEMENTSEnterpriseSolutionsCapturedatacomgrowthinkeybusinesscenterswithleading-edgeproductsandsuperiorcustomerserviceTopbusinessdistrictsinmajorurbanareas;onlythemostdenseareasinshorttermFocusedDeploymentLeverageexistingconduitstolayinmajorurbanareasSuperiorserviceandbandwidthTargetCT’sweaknessinserviceandbandwidthUtilizeLMDSinintermediatecitiesandareaswheretimetomarketiscriticalWholesale/CarrierTargetmobilecarriersandISPswithbackbonetransport;considersupplyingfixed-lineincumbentsCoverPOPsinallmajorcallingzones;developlocalleasedlinesnetworkinkeylocationsAggressivedeploymentofbackboneinfrastructuretoprovideunparalleledbandwidthEstablishhighbandwidthinternationalgatewaytodifferentiateinternetaccessSuperiorservicewithclearpositioning“TheclearalternativetoCT”ISPLongdistancevoiceCaptureearlyrevenuefromtofunddevelopmentofsubsequentbusinessmodelsTop60POPsbyendofyear2000utilizingmixofleasedlinesfromCTandCNCnetworkPositionoffnetvoiceasfirstproductfrom“China’sfirstdatacomcarrier”DonotoverextendresourcesinVOIPasitdoesnotfitCNC’slongtermstrategyCreate“dial-around”solutionsforbusinessandinterconnectterms-17930-

EnterprisesolutionsPOTENTIALBUSINESSMODELSCOVERWIDERANGEOFPRODUCT/MARKETALTERNATIVESOpportunityforgrowthCurrentmarketsizeWholesale/carrierConsumerISP?DomesticandInternationalLongDistanceVoiceResidentialMed/largeenterprisecustomersCarriersPotentialtrafficperconsumerProductsEmergingdatacomDataVoiceEmergingdataniche

AGENDABusinessModelsDomesticandinternationallong-distancevoiceWholesale/carrierEnterprisesolutionsIssuesgoingforward

APPROACHTODOMESTICANDINTERNATIONALVOICEBUSINESSMODELObjectivesHypothesizedApproachCaptureearlyrevenuefromlaunchofprepaidIPcallingcards“Cashcow”forfundingotherbusinessmodeldevelopmentPursueprefixandequalaccesslongdistanceforbusinesscustomersassoonaspossibletobeginestablishingrelationshipsManagepricingandproductlifecycleeffectivelytomaximizetotalmarginandavoidinvestingindecliningproductsDonotoverextendourselvesnorblurour“datacom”imageFighttheregulatorybattletoensurefavorableapproachestoequalaccessandinterconnectMarketcallingcardstobusinesscustomersintheshorttermfortravellingpersonnelEmphasizequalityimage/brandtodistinguishfromCTandUnicom--positioncallingcardasfirststepinbecominganextgenerationfullservicesproviderEstablishmechanismstolinkmarketingexpenditureswithrevenueandmargingrowthbyproducttoensureeffectiveinvestmentEmphasizelowcosttargetedmarketingandloyaltyprogramsDonotoverextendAlwaysemphasizeadvancedtechnologyandevolutiontofullservicesprovision

DOMESTICANDINTERNATIONALVOICESUMMARYPreliminaryEconomicsPhaseICapEx(2000,2001):~3.8BRMBFiber/construction:~2.4BRMBIP/DWDMequipment:~720MRMBPOP/VOIP:~530MRMBOSS/Networkmanagementsystem:~100MRMBOpExexpectedtobe~30%ofrevenueby2002Marketshareandrevenueestimates-2002OffnetDLD:30%OffnetILD:30%~$2BRMBIPIntl.termination:27%5yearNPV:Essentiallybreakevenconsideringoffnetvoicealone1KeyIssuestobeAddressedInterconnectagreementswithlocalPTA’s;attempttoobtainblanketpolicyfromMIIInternationalgatewaylicenseandconnectivitySettlementchargescommensuratewithVOIPpricingDevelopmentofbusinessoffnetstrategyScalable“dial-around”solutionsinshorttermEqualaccesslongertermQualityofserviceforvoice,mustapproachswitchedqualityrapidlyPointofdiminishingreturnsforaddingVOIPgatewaysvs.strategicvalueofprovidingcoverage(1)Highlysensitivetosettlementfees

LARGEMARKETWITHPOTENTIALTOGAINSHAREQUICKLYNewentrantstypicallygainsharequicklyExample:IDDandDLDservicesMarketsizeable-off-nettrafficaccountsfor~15%oftotalDLD/ILDrevenueby2004Source:ChinaTelecomannualreports;CNC’steaminputs;BCGsurveys,analysis&benchmarkingYearafterentryOptus(DLD)Tele2(DLD)Mercury(DLD)HongKong(IDD)Japan(IDD)US(IDD)(RMBBN)DLDOn-NetDLDOff-NetILDOn-NetILDOff-Net(%)

CAREFULMANAGEMENTOFPRE-PAIDCALLINGCARDBUSINESSNECESSARYTOALIGNWITHLONGTERMSTRATEGYPrepaidcallingcardscallfordifferentcapabilitysetandtargetcustomersthanlongertermbusinessmodelsFocusonconsumerswillnotcomplementlongtermvisionofprovidingenterprisesolutionsMassadvertisingandmarketingaroundalow-costpositionmaynotfitimagerequiredforfutureneedsThreefactorsimportanttoconsiderinmanagingprepaidcallingcardbusinessAttempttopositioncardsinmarketingmessagesasthefirstproductfromacompanythatisbuildingthemostadvancednetworkinPRCConsidersellingcardstobusinessesfortheirtravelingpersonneltobeginestablishingenterpriserelationshipsCarefullymanageproductlifecycletobeginpullingbackmarketinginvestmentaswholesaleandenterprisebusinessmodelsgrow

CNCVOIPREVENUEANDMARKETSHAREEXPECTATIONSSource:CNC’steaminputs;variousbenchmarks;BCGanalysisVoicerevenueShareassumptionsCNCRevenue(RMBBN)Off-NetDLD%oftotalCNCrevenue100%76%37%30%23%16%Off-NetILDInternationalTermination19993%80%1%3%80%1%5%80%0%Off-NetDLDOff-netshareoftotalDLDGeographiccoverageofCNCCNCsharewithincoverageOff-NetILDOff-netshareoftotalILDGeographiccoverageofCNCCNCsharewithincoverageInternationalTerminationIPshareoftotalGeographiccoverageofCNCCNCsharewithincoverage200010%60%25%11%60%25%11%60%20%200117%75%29%18%75%29%18%75%25%200223%90%33%26%90%33%24%90%30%200330%100%30%33%100%30%30%100%30%200432%100%28%35%100%28%35%100%31%

PRELIMINARYECONOMICSFORLONGDISTANCEVOICEMODEL(PHASEIBUILDOUT)VOIPRevenueAloneJustifiesBuildingBackbone5yearPV(1)(MRMB)CapEXOpExRevenue5yearNPV@15%:~-500MRMB5yearIRR:~12%EssentiallybreakeveneconomicsforoperatingbackboneforVOIPonlyVOIP(2)BackboneconstructionBackboneInternationalterminationIDDDLDIPPOP/AccessplatformOSSPresentvalueofcashflows(1)Assuming15%costofcapital(2)Includingsettlementchargesestimatedat10%ofVOIPrevenue,andmarketing/salesat10%ofrevenue(3)BackboneOpExchargesallocated1/3eachtoVOIP,wholesale,andenterprisebusinessmodeleconomicsSource:BCGbenchmarkdatabase;industryinterviews;BCGanalysis

AGENDABusinessModelsDomesticandinternationallong-distancevoiceWholesale/carrierEnterprisesolutionsIssuesgoingforward

APPROACHTOWHOLESALE/CARRIERBUSINESSMODELObjectivesHypothesizedApproachDevelopwholesalebusinessastrafficgeneratortoimproveeconomicsofbackbonethroughhigherutilizationBecomethewholesalecarrierofchoicewithtechnologicallysuperiorserviceofferingsincludinghighbandwidthinternationalgatewayconnectivityConsiderwholesalingaccesstoCT,Unicom,andJitongdependingoncompetitiveimplicationsSuperiorcustomerservicewithclearpositioning“TheclearalternativetoCT”AggressivedeploymentofbackboneinfrastructureConnectingtop15citiesbyendof2000andexpandingtotop50citiesby2002Seekpartnershipstoestablishhighbandwidthinternationalgatewayconnectivity--absolutelyessentialfordifferentiatingCNCofferingDevelopinterconnectioncapabilitiesinallmajorPOPsandmobilebasestationsinkeygeographicallocationsWholesaleaccesstoincumbentproviderswherefeasible,butdonotwholesalesourcesofcompetitiveadvantage(e.g.,enhanceddataservicessuchasIPVPNs)RolloutproductofferinginstagedmannertoensurequalityofserviceInternetconnectivityMobileinterconnectAccessportstobackbone

WHOLESALE/CARRIERSUMMARYPreliminaryEconomicsPhaseICapEx(2000,2001):~100MRMBISPaccessplatform:~50MRMBOSS/Provisioningsystems:~50MRMBOpExexpectedtobe~10%ofrevenueby20021Marketshareandrevenueestimates-2002Mobile(backbone):15%ISPs:9%~1.1BRMBAccessports:100%2Darkfiber:100%25yearNPV:~$2.1BRMBAssumeslaunchdateof3Q2000forleasedlinesandrelativelyaggressivemobilesharesPotentiallytoooptimisticKeyIssuestobeAddressedBackbonetechnologyplatform-QOSforvoicevs.lowercostdeployment?High-bandwidthinternationalgatewayparamounttodifferentiatingISPaccessFavorableregulatorybackingforcourtingregionalCTmobilecarriersEnsuringexistingVOIPgatewayscanservewholesaleneedsRevenueopportunityofwholesalingdarkfibervs.enablingcompetitionOrganizationalchallenges(1)IncludingallocationofbackboneOpEx(2)MarketestimatesbasedonrevenuegenerationbyCNCalone

POTENTIALWHOLESALECUSTOMERSINCLUDEISPs,MOBILEOPERATORS,ANDFIXEDLINECARRIERSISPsoffersignificantpotentialifCNCcanprovidesuperiorbandwidthaccessandtointernationalgatewayCurrentsatisfactionamongregionalISPsverylowInternationalgatewaylicenseinconjunctionwithhighbandwidthtrans-oceaniccarrieralliancecouldprovidevastlysuperiorserviceMobilecarrierswillbesearchingforlowercostalternativestocarrylongdistancetrafficduetointensifyingcompetitionCNC’snewhighcapacityVoIPnetworkandinternationalgatewaylikelytoyieldlowercostsFixedlinecarrierspotentiallylookingforalternativesExistinglong-haultransportinfrastructurelimitedChinaTelecomcouldevenbeapossiblecustomergivencurrentfocusonincreasingresidentialteledensity

OVERALLWHOLESALEMARKETSIZEISSUBSTANTIAL

ANDGROWINGATAMODESTRATEAnticipatedPriceDecreaseinLeasedLinesLimitsOverallRevenueGrowthLeasedLines-ISPMarketSize(RMBB)15TotalLeasedLines-Mobile99’-04’CAGRAccessPortsLeasedLines-Paging1818202226284%41%1%152%(1)9%(1)01’-04’CAGRSource:CNCteaminputs;foreignbenchmarks;BCGanalysisDarkFiber68%(1)

CARRIERSSEEKINGALTERNATIVES...ISPsdefinitelyseekingalternativestoCTMobilecarrierslikelytofollow“Weneedatelecomserviceproviderthatisnotourcompetitor.”-Founder,Eastnet“ChinaTelecom,withtheirownnetworkdevelopmentplans,tendstostarveusoncapacityortoforceustopayinadvanceforexcesscapacity.”-Manager,Infohighway“ThefactthatittakesChinaTelecomtwomonthseverytimeweneedanextralinemakesitverydifficulttohaveourowncustomers.Wewantanotheroperatorwhocangetusleasedlinesfast.”-Manager,InfohighwayMobilecarriersmightconsiderdivertingpartoftheirtraffictoalternativeserviceproviderswith:moreattractivepricinghigherqualityservicehigherbandwidthInterviewswithregionalmobilecarriersandUnicomneedtobeconductedtoverifypotential

…BUTTECHNOLOGICALLIMITATIONSANDCOMPETITIVECHALLENGEAREIMPORTANTFACETSTOMANAGECompetitiveChallengeTechnologicalLimitationsMobilecarriersmaybehesitanttouseVOIPtechnologyforprimaryapplicationsCarrierscurrentlyaddressingsoundqualityasamajorimprovementinitiativeVOIPhasyettodelivertoll-qualityvoicetransmission,evenonlandlineMobilecarriersmaytakeviewthatVOIPcouldfurtherdegradevoicequalityChinaTelecomlikelytohaveadvantageincompetingshareofCTMobile’sbusinessStrongformerintra-CTconnectionevenaftersplitExtensivebackbonecoverageandlargeTDMbasedcapacityUnicomMobileServices’businessastoughtargetBuildpresencebyofferinglow-costtrialsandbackupcapacityLobbyforclearregulationfromMIIonfreedomofchoiceforcarriers

PREDICTEDWHOLESALEECONOMICSADDSIGNIFICANTVALUETOVOIPBUSINESSMODELAdditionalCapExandOpExMinimal5yearPV(1)(MRMB)CapEXOpExRevenue5yearNPV@15%:~2.1BRMB5yearIRR:~40%WholesalecriticaltoenhancingprofitabilityofbackboneVOIPBackboneallocationDarkFiberAccessportsISPsMobileoperatorsVOIPVOIPISPaccessOSS(1)Assuming15%costofcapitalSource:BCGbenchmarkdatabase;industryinterviews;BCGanalysisOSS/provisioningPresentvalueofcashflows8,0007,0005,0001,0006,000-3,000-4,000

AGENDABusinessModelsDomesticandinternationallong-distancevoiceWholesale/carrierEnterprisesolutionsIssuesgoingforward

APPROACHTOENTERPRISESOLUTIONSBUSINESSMODELObjectivesHypothesizedApproachCapturestrongshareamongmedium/largebusinessbyofferingenhanceddatacomsolutionsGoaltoestablishclearpositionasbestservice/qualityproviderinmajormarketsUtilizemostcosteffectivedeploymenttechnologiestocovermajormetroareasMinimizehead-to-headcompetitionbyofferingdifferentiated,data-centricproducts--attempttodrivedatacommarketDevelopimageasfast,responsivesolutionsproviderEnablecompetitiveadvantageforbusinesscustomersthroughdatacomForbuildingmanagers:maketheirbuildingsmoreattractivetotenantsDeploymenttotargetkeybuildingsinmajormetropolitanareasFourcitiesbyyear2000/01Top15citiesby2001Fiberinmostdenseurbanhi-riseareasandLMDStocomplementandservelessdenseareasInitialleadproductswillbelowcostvoiceoverIPandhighbandwidthinternetaccessMigrationtofulldatacomsolutionsascustomerbaseandcapabilitiesgrowQualitycustomerservicemoreimportantshorttermthanfullproductofferingEmphasisoneaseofuseandfastprovisioningversuscompetitors--exploitCT’sweaknessesEducationofcustomersonuseofdatacomproductsascompetitiveweaponsMarketingpartnerwithkeybuildingmanagers

ENTERPRISESOLUTIONSSUMMARYPreliminaryEconomicsPhaseICapitalInvestment(2000,2001):~1.1BRMBFirstfourcities(assumingfiber):~650MRMBAdditional11cities1:~400MRMBOpExexpectedtobe~40%ofrevenueby2002Marketshareandrevenueestimates-2002OffnetVoice2:~20%Existingdata:~10%~1.1BRMBEmergingdata:~5%5yearNPV:Roughly1.2BRMBAssumeslaunchdateof3Q2000fordataservicesLikelytoooptimisticKeyIssuestobeAddressedRightofwayforexistingductsanddiggingPartnershipstrategyforhighbandwidthIGWRightstoLMDSfrequencyspectrumArethe15citiesdesignatedforPhaseIbuildouttheright15citiesforlocalaccess?Tradeoffbetweenpureeconomicsbycityvs.strategicvalueofprovidingend-to-endconnectivityWhatisarealistictimeframeforlaunch?Magnitudeoforganizationalandhumanresourcerequirements(1)AssumingLMDScapitalandrevenue2timesFuzhouestimateforcities11-15;3timesFuzhouestimateforcities5-10(2)Assumesnolocalvoicerevenuethrough2004

ENTERPRISESOLUTIONSBUSINESSMODELMOSTCOMPLEXWITHHIGHCAPEXANDOPEXREQUIREMENTS...BuildingmetropolitanfiberringstoofferaccesstomediumandlargebusinessesposessignificantchallengeOperatingexpensesrequireddwarfslonghaulnetworkcostsonapercitybasisComplexityinobtainingnight-of-wayvariesbydistrictswithineachcityDesigningfiberrouteandnetworkconfigurationrequiressignificantexperienceConvertingcustomerstofullCNCservicemaynotbeaseasyasitseemsonsurfaceInitialriskforcompaniesutilizingnewentrantCoverageissuesforofferingservicetoallbusinesslocationsExperiencedsales-forcewithestablishedrelationshipsamust

…BUTCOMPRISESTREMENDOUSUPSIDEPOTENTIALInternetAccessLeasedLinesILDDLDLocalOtherPortalBroadbandContentWebHosting/CollocationExistingServicesEmergingServices98-04CAGR124%40%-10%7%11%IPVPNBroadbandNetworkApplications71%83%186%98%111%286%00-04CAGRMarketsize(RMBBN)Marketsize(RMBBN)7896187Overall16%Overall86%332Source:CNCteaminputs;foreignbenchmarks;BCGanalysis

CUSTOMERNEEDSEXISTTHRUGHOUTTHEVALUECHAINCT’sOfferingYieldsSignificantGapsLearnBuyGetUse/supportPayCustomervaluechainNeedsidentifiedHowdatacomservicescanhelptheirbusinessAssistancedeployingsolutionsQuickerandmoreconvenientapplicationchannelsRapidandreliableprovisioningFaster,reliablerepairservicesPrompt,customizedbillingLackcustomerfocusSolutionsvirtuallynon-existentMostlyone-wayproductmarketingNocustomerinputforprovisioningCTdeterminesqueuewithoutspecifictimingNopenaltiesformissedappointmentsNegligentrepairserviceSlowfulfillment&technicalsupportresponsePoorresponsetocustomersLimitedbillcustomizationCTapproachSignificantopportunityforCNCestablishpositionincustomersolutions,easeofuse,andresponsiveserviceAreashighlightedmostincustomerinterviewsSource:Customerinterviews;BCGanalysis

STAGEDPRODUCTINTRODUCTIONNECESSARYTOMANAGEQUALITYHypothesizedProductIntroductionsVoiceData200020012002200320042008PhaseI&IIPhaseIIIPhaseIVLeasedLinesMobilecarriersEneterpriseHighbandwidthdedicatedinternetaccessforbusinessesandISPsAccessPortsVPNBasicenterpriseBroadbandapplicationsPlatformstoenableVOD,etc...WebHostingDarkFiberResidentialISP?AdvancedVPNExtranetVoice,videoQoSguaranteesIndustryspecificofferingsOtheremergingservices(e.g.e-Commerce)IP-phonevoicePrefix“Dial-around”solutionsEqualaccessvoice?On-netvoice?FocusonqualityoverquantityMarketasintegratedproductsStressCNCroleasintegrateddatacomplayerPositioningIssues

CNCSHOULDUSECREATIVEWAYSTOGROWTHEMARKET,AVOIDHEADTOHEADCOMPETITIONCompetitorsallfocusonthesamedemandfromthesamecustomersSavagelycompeteonpriceReactivelywaitforcustomerstoidentifyneed,requestproductsPursuegrowingcustomers-dataintensiveenterprisesFreshopportunitiesforsales,insteadofcompetingoverexistingbusinessApproachproactivelywithnewproducts,insteadofwaitingforcustomerstoinitiatesalesprocessCreativelyidentifynewmarketsI.e.marketforcompaniesrequiringveryrapidprovisioningorcustomizedproductsBecometheonlychoiceforthesecompaniesLobbythegovernmenttosupportmoree-commerceandinformationindustriesgrowthCTCNCUnicomJitongCTislikelytobeunabletomeetgrowingdemandaloneTraditional,narrowviewNewapproachestogrowingsales

TOTALGDPVS.GDP/CAPITAISAPRELIMINARYINDICATORFORATTRACTIVELOCALACCESSMARKETSExample:15InitialCitieswithPOPsonCNCNetworkShanghaiBeijingGuangzhouTianjinHangzhouWuhanNanjingJinanShijiazhuangZhenzhouChangshaXuzhouXiamenFuzhouShenzhenExamplesofadditionalcitiesnotininitial15designatedforCNCPOPsHypotheticalbreakevencurveforbuildinglocalaccessSuzhouWuxiTotalGDP(kRMB)GDP/cap(kRMB)

VERYDENSEMARKETSSUCHASSHANGHAIBESTSERVEDBYMETROFIBERRINGSMPOP/railstationHongQiaoDevelopmentAreaPeople’sparkHuaiHaiRoadXujiahuiPudongFinancialZoneFiberlength:Alongsubway:Alongelevatedringroad:Alongroad:17000m9000m8000m#ofmajorbusinessbuildingsaccessed:~200FibersalongSubwayinconstructionSubwayElevatedringroadRoad(digrequired)DenseBusinessAreaservedMetrostationsMMM

SHANGHAIECONOMICSVERYATTRACTIVEDUETOHIGHBUILDINGANDBUSINESSDENSITY5yearPV(1)(MRMB)CapEXOpExRevenue5yearNPV@15%:~310MRMB5yearIRR:~70%ShanghaipresentsmostattractiveenterprisesolutionsmarketSG&AAllocatedbackboneIDDEmergingdata(3)DLDDataservicesSONET/switchingequipmentOSSAllocatedbackbone(2)(1)Assuming15%costofcapital(2)CostofprovidingF/RandATMserviceonbackboneallocatedoverfirst4cities(3)WebhostingIPVPNS,etc.Source:BCGbenchmarkdatabase;industryinterviews;BCGanalysis;realestateagencyinterviews;fieldanalysisPowerprovisioning,etc.FiberconstructionRightofwayPresentvalueofcashflows

MEDIUMSIZEDCITIESWITHHIGHGDP/CAPITASUCHASFUZHOUBESTSERVEDWITHLMDSSOLUTIONFiberlength:Alongroad:#LMDSstation:5000M1Areaserved(1):#ofmajorbusinessbuildingscovered:~40km2~40(2)LakeFiberalongroadRailwayRailwaystationRoadLMDSstationMajorbuildingsAreaservedRS(1)MoredetailedfieldanalysisrequiredtomapbuildingsandmosteffectiveLMDSpositioning;assumes3.5kmradiusforLMDSarea(2)AssumehalfofthebuildingsareprimebusinessbuildingsforeconomicmodelingSR

PRELIMINARYFUZHOUECONOMICSUTILIZINGLMDSVERYFAVORABLE5yearPV(1)(MRMB)CapEXOpExRevenue5yearNPV@15%:~20MRMB5yearIRR:~60%LMDSsolutionsformediumsizedcitieswillplayacriticalroleindevelopingenterprisesolutionsSG&APower,provisioning,etc.IDDEmergingdataservicesDLDDataservicesBasestationCPE(1)Assuming15%costofcapitalSource:BCGbenchmarkdatabase;industryinterviews;BCGanalysis;realestateagencyprovideddataBldgequipmentSpectrumfeesFibertoPOPPresentvalueofcashflows

OTHERCITIESOFSIZEABLEPOPULATIONBUTRELATIVELYLOWGDP/CAPITAMAYNOTWARRANTINVESTMENTExample:ShijiazhuangNofiberconnectionrequired,assumerailstationisLMDSbase1Areaserved(1):#ofmajorbusinessbuildingscovered:~40km2~20(2)RailwayRoadLMDSstationMajorbuildingsAreaservedSS(1)MoredetailedfieldanalysisrequiredtomapbuildingsandmosteffectiveLMDSpositioning;assumes3.5kmradiusforLMDSarea(2)Assumehalfofthebuildingsareprimebusinessbuildingsforeconomicmodeling

OVERALLECONOMICSAPPEARMARGINALFORSHIJIAZHUANG5yearPV(1)(MRMB)CapEXOpExRevenue5yearNPV@15%:~-3MRMB5yearIRR:~5%CitieswithoutdensebusinessdistrictsmaynotbeattractiveenterprisemarketsregardlessofoverallsizeSG&APower,provisioning,etc.IDDEmergingdataservicesDLDDataservicesBasestation(1)Assuming15%costofcapitalSource:BCGbenchmarkdatabase;industryinterviews;BCGanalysis;realestateagencyprovideddataSpectrumCPEBldg.equipmentPresentvalueofcashflows

OVERALLREVENUEANDMARKETSHAREEXPECTATIONS:ENTERPRISESOLUTIONSPredominatelyvoice(DLD/ILD)revenueinthefirsttwoyears;migratingtodataandInternetservicesby2002CNCrevenue(RMBBN)InternetAccessLeasedLinesILDDLDShareassumptionsOtherEmergingServicesWebHosting/CollocationSource:CNCteaminputs;foreignbenchmarks;BCGanalysis19993%80%1%3%80%1%0%0%0%0%0%0%DLDOff-netshareoftotalDLDGeographiccoverageofCNCCNCsharewithincoverageILDOff-netshareoftotalILDGeographiccoverageofCNCCNCsharewithincoverageLeasedLinesGeographiccoverageofCNCCNCsharewithincoverageInternetAccessBroadbandNarrowband/Dial-UpWebHosting/CollocationOtherEmergingServices200010%60%25%11%60%25%30%2%2%0%0%0%200117%75%29%18%75%29%47%10%10%0%5%1%200223%90%33%26%90%33%63%14%14%0%8%2%200330%100%30%33%100%30%80%18%18%0%10%4%200432%100%28%35%100%28%82%21%21%0%13%6%

OVERALLECONOMICSATTRACTIVEFORPHASEIBUILDOUTINTOPFOURCITIES5yearPVs(MRMB)CapExOpExRevenue5yearcityNPV5yearIRRShanghaiBeijingGuangzhouShenzhenTotal1451491579554650444740033216839607686404802848311172835370%45%30%28%OverallPhaseI5yearNPV:~620MRMB5yearIRR:~44%Source:BCGbenchmarkdatabase;industryinterviews;BCGanalysis

GOINGFORWARD,CITIESWILLNEEDTOBEANALYZEDONACASEBYCASEBASISDeploymenttechnologywillplayacriticalroleMethodology/criteriaforchoosinglocalaccessmarketsInitialprioritizationbytotalGDPvs.GDP/capitaRelevanceandproximitytoCNCnetworkMapurbanareabybiggestbuildingsandavailabilityofexistingconduitsDetermineifdensityfallsintooneofthethreedensitycategoriesEstimatecostsandrevenueassociatedwithbuildout1.2.3.4.5.Goornogo!CosttodeliverenterprisesolutionsIncreasingbusinessdensityandareaIntermediatedensitybestservedbyLMDSVerydenseandlargeareabestservedbyfiberToocostlytoserveFiberLMDS

RECAPOFOVERALLPHASEIECONOMICSANDKEYISSUESEnterpriseSolutions21.1B3.2B(38%)1.2BBusinesses/km2DatagrowthIGW/connectivityDeploymentcitiesRealisticrolloutBuildouteconomicsfor15citiesvs.connectivityvalueWholesale/Carrier100M2.3B(27%)2.1BMobileshareInternetgrowthIGW/connectivityVoiceQOSRegulatorybackingCostofdeploymentvs.serviceflexibilityLongdistancevoice3.8B3B(35%)--SettlementchargesPricing/competitionIGW/connectivityManaginglifecycleBusinesssolutionsEconomicsof60VOIPcitiesvs.strategicvalueofcoverageEconomics1CapEx2004Revenue(%oftotal)5YRNPV3KeyIssuesSensitivityTopissuestoaddressTradeoffs(1)AllvaluesinRMBandbasedonpreliminaryinputstoberefined(2)IncludesonlyPhaseIbuildouttotop15cities(3)Assuming15%costofcapital

AGENDABusinessModelsDomesticandinternationallong-distancevoiceWholesale/carrierEnterprisesolutionsIssuesgoingforward

EMERGINGOPPORTUNITIESEXISTFORCONSUMERISPANDADVANCEDDATASERVICESResidentialISPCNCmaybeinuniquepositiontooffertruebroadbandinternetaccessduetoIPnetworkandinternationalgatewayWhatstrategieswillcapturesignificantvaluewhileminimizingdevelopmenttimeandnecessityforbrandequity?WebHosting/DataCentersNichecompetitorssuchasExodusintheU.S.aggressivelypursuingthisbusinessmodelWillopportunitiesdevelopintheneartermforChinaandcouldCNCsupplyresourcesnecessary?E-commercesolutionsManytelcosinEuropeandU.S.offeringe-commercesolutionsWillopportunitiesdevelopintheneartermforChinaandcouldCNCsupplyresourcesnecessary?

DatacomservicesexplosionSlowedadoptionStablecompetitionwithCT,Unicom,andJitong;clearregulationsIncreasedcompetitionwithlimitedcooperationfromCTFragmented,unstablecompetition;multipleentrantsandunclearregulationsBasecaseBestWorstDemandsideCompetitive/RegulatorySituation(Supplyside)ENVIRONMENTALUNCERTAINTIESLEADTOTHREEBASICSCENARIOSTOBEANALYZEDGrowthinexistingdataandandemergingdatacomservices(asexpected)

MONTECARLOSIMULATIONWILLALLOWFORGAUGINGTHEEFFECTSOFUNCERTAINTIESIMPLIEDINSCENARIOSExample:EffectofAverageBuildingSize,Tier1BusinessProportion&SpendingonShanghaiMetroAccessEconomicsEstablishInputVariables25,000.0028,750.0032,500.0036,250.0040,000.00Averagebuildingsize(m2)MinMostlikelyMax7.5%11.3%15.0%18.8%22.5%%Tier1businessesMinMostlikelyMax300.00350.00400.00450.00500.00Averagespending/sqmforTier1(RMB)MinMostlikelyMaxProbabilityMonteCarlosimulationof1000trialswith5yearNPVasforecastoutputFrequencyChartCertaintyis95.00%from$238,500to$558,816000RMBMean=$381,016.000.023.046.068.091022.7545.568.2591$150,000$262,500$375,000$487,500$600,0001,000Trials6OutliersForecast:5YRNPVResultingforecast

MONTECARLOSIMULATIONPROVIDESVERYUSEFULOUTPUT95%certaintythatwiththeinputsprovided,5yearNPVwillbegreaterthan239MRMBStatisticallyimpossiblefortheprojecttohaveanegativeNPVbasedonprovidedinputsForecastmeanisactuallyhigherthanourbasecasevalue(381Mvs.318M)duetoeffectsofvariableinputsAsensitivityreportgeneratedfromthesimulationtellsusthataveragebuildingsizecontributesthemosttooutputvariance,thereforeitisthemostimportantinputtofocusonclarifying

CONTENTKeystrategicprinciplesRegulatoryoverviewMarketoverviewCompetitionoverviewBusinessmodelsNextsteps

NEXTSTEPSAgreeonbusinessmixassumptionsDeveloporganizationstructureAgreeonkeyprinciplesandobjectivesTimeline,keymilestonesDevelopimplementationactionplanHighlevelplan(byquarters)tillJan2002Detailedplan(bymonth)Jan-Jul2000Keymilestones,processcontrolIntegrateandrefineoverallCNCfinancialObjectivesandassumptionsforfinancialmodelScenarios/sensitivities

ORGANIZATIONDESIGNMETHODOLOGYDefineprinciples&objectivesKeycriteriaDesignorganizationstructurePossibilityofcombination/hybridmodelsDefinejobresponsibility/accountabilitycorrespondingtoorganizationstructureExampleforprocessflow(howeachfunctioninteracts)ExampleforKPI,principlesforKPISelectmodelstotest

MAJOROUTPUTS:ORGANIZATIONDESIGNKeyprinciplesforKPIWithexamplesDivision/accountability“Internalmarket”ascross-deptincentiveOrganizationchartDottedlinevs.solidlineReporting/accountabilityRationale/methodology

IMPLEMENTATIONPLANDESIGNMETHODOLOGYObjective/targetscheduleMajorfunction/moduleworkingbackwardDetailedworkandcycletimeformodule/sub-module®refinetimelineDraftimplementationtimelineKeychecklist&milestonesperdivisionKeyprocessforrollout(acrossdivisions)ProductrolloutGeographicrolloutRevisetargetifnecessaryIdentifybottleneck,refinescheduleSegmentedviewofimplementation

Keycross-functionalcoordinationprocessflowExamplesMAJOROUTPUTS:IMPLEMENTATIONPLANKeyrolloutplanexampleProductCityMSprojecttime-line/milestonesOverallBydivisionHighlightsMajormilestonesresourceplanning

WORKPLAN(1)(1)RefertoCNCteamschedulefordetails.TDCoffDec22-30;TCoffDec20-24;RestoffDec27,31forholiday

您可能关注的文档

- ××的战略分析框架(英文PPT99

- XX的战略分析框架(英文PPT99

- XX的战略分析框架(英文PPT99页)

- 战略成本管理(英文PPT16

- 战略成本管理(英文PPT16页)

- 战略分析工具(英文PPT34

- 战略分析工具(英文PPT34页)

- 建立战略中心型组织的工具(英文PPT9

- 网通战略咨询报告(英文PPT22

- INTERVIEWWORKSHOP(英文PPT29

- JITPURCHASING(英文PPT20

- 介绍江西的英文PPT

- 精益生产工具(英文PPT22

- 大客户销售谋略英文PPT

- 圣诞节英文PPT

- 美国能源部平衡计分卡导向管理培训资料(英文PPT66页)

- 美国能源部平衡计分卡导向管理培训资料(英文PPT66

- 6西格玛(英文PPT 53页)