- 1.06 MB

- 2022-05-26 16:46:07 发布

- 1、本文档共5页,可阅读全部内容。

- 2、本文档内容版权归属内容提供方,所产生的收益全部归内容提供方所有。如果您对本文有版权争议,可选择认领,认领后既往收益都归您。

- 3、本文档由用户上传,本站不保证质量和数量令人满意,可能有诸多瑕疵,付费之前,请仔细先通过免费阅读内容等途径辨别内容交易风险。如存在严重挂羊头卖狗肉之情形,可联系本站下载客服投诉处理。

- 文档侵权举报电话:19940600175。

CHAPTER10TheTermStructureofInterestRates

15-2Theyieldcurveisagraphthatdisplaystherelationshipbetweenyieldandmaturity.Informationonexpectedfutureshorttermratescanbeimpliedfromtheyieldcurve.OverviewofTermStructure

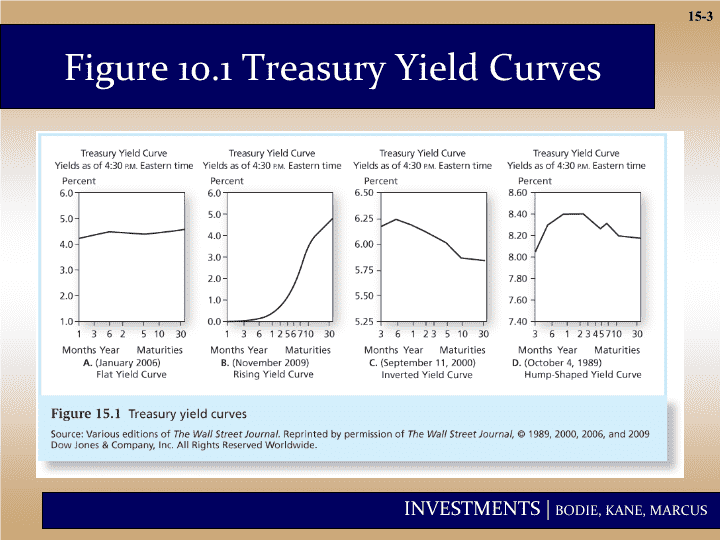

15-3Figure10.1TreasuryYieldCurves

15-4BondPricingYieldsondifferentmaturitybondsarenotallequal.Weneedtoconsidereachbondcashflowasastand-alonezero-couponbond.Bondstrippingandbondreconstitutionofferopportunitiesforarbitrage.Thevalueofthebondshouldbethesumofthevaluesofitsparts.

15-5Table10.1PricesandYieldstoMaturitiesonZero-CouponBonds($1,000FaceValue)

15-6Example10.1ValuingCouponBondsValuea3year,10%couponbondusingdiscountratesfromTable15.1:Price=$1082.17andYTM=6.88%6.88%islessthanthe3-yearrateof7%.

15-7TwoTypesofYieldCurvesPureYieldCurveThepureyieldcurveusesstrippedorzerocouponTreasuries.Thepureyieldcurvemaydiffersignificantlyfromtheon-the-runyieldcurve.On-the-runYieldCurveTheon-the-runyieldcurveusesrecentlyissuedcouponbondssellingatornearpar.Thefinancialpresstypicallypublisheson-the-runyieldcurves.

15-8YieldCurveUnderCertaintySupposeyouwanttoinvestfor2years.Buyandholda2-yearzero-or-Rolloveraseriesof1-yearbondsEquilibriumrequiresthatbothstrategiesprovidethesamereturn.

15-9Figure10.2Two2-YearInvestmentPrograms

15-10YieldCurveUnderCertaintyBuyandholdvs.rollover:Nextyear’s1-yearrate(r2)isjustenoughtomakerollingoveraseriesof1-yearbondsequaltoinvestinginthe2-yearbond.

15-11SpotRatesvs.ShortRatesSpotrate–theratethatprevailstodayforagivenmaturityShortrate–therateforagivenmaturity(e.g.oneyear)atdifferentpointsintime.Aspotrateisthegeometricaverageofitscomponentshortrates.

15-12ShortRatesand

YieldCurveSlopeWhennextyear’sshortrate,r2,isgreaterthanthisyear’sshortrate,r1,theyieldcurveslopesup.Mayindicateratesareexpectedtorise.Whennextyear’sshortrate,r2,islessthanthisyear’sshortrate,r1,theyieldcurveslopesdown.Mayindicateratesareexpectedtofall.

15-13Figure10.3ShortRatesversusSpotRates

15-14fn=one-yearforwardrateforperiodnyn=yieldforasecuritywithamaturityofnForwardRatesfromObservedRates

15-15Example10.4ForwardRatesTheforwardinterestrateisaforecastofafutureshortrate.Ratefor4-yearmaturity=8%,ratefor3-yearmaturity=7%.

15-16InterestRateUncertaintySupposethattoday’srateis5%andtheexpectedshortrateforthefollowingyearisE(r2)=6%.Thevalueofa2-yearzerois:Thevalueofa1-yearzerois:

15-17InterestRateUncertaintyTheinvestorwantstoinvestfor1year.Buythe2-yearbondtodayandplantosellitattheendofthefirstyearfor$1000/1.06=$943.40.0r-Buythe1-yearbondtodayandholdtomaturity.

15-18InterestRateUncertaintyWhatifnextyear’sinterestrateismore(orless)than6%?Theactualreturnonthe2-yearbondisuncertain!

15-19InterestRateUncertaintyInvestorsrequireariskpremiumtoholdalonger-termbond.Thisliquiditypremiumcompensatesshort-terminvestorsfortheuncertaintyaboutfutureprices.

15-20ExpectationsLiquidityPreferenceUpwardbiasoverexpectationsTheoriesofTermStructure

15-21ExpectationsTheoryObservedlong-termrateisafunctionoftoday’sshort-termrateandexpectedfutureshort-termrates.fn=E(rn)andliquiditypremiumsarezero.

15-22Long-termbondsaremorerisky;therefore,fngenerallyexceedsE(rn)TheexcessoffnoverE(rn)istheliquiditypremium.Theyieldcurvehasanupwardbiasbuiltintothelong-termratesbecauseoftheliquiditypremium.LiquidityPremiumTheory

15-23Figure10.4YieldCurves

15-24Figure10.4YieldCurves

15-25InterpretingtheTermStructureTheyieldcurvereflectsexpectationsoffutureinterestrates.Theforecastsoffutureratesarecloudedbyotherfactors,suchasliquiditypremiums.Anupwardslopingcurvecouldindicate:RatesareexpectedtoriseAnd/orInvestorsrequirelargeliquiditypremiumstoholdlongtermbonds.

15-26InterpretingtheTermStructureTheyieldcurveisagoodpredictorofthebusinesscycle.Longtermratestendtoriseinanticipationofeconomicexpansion.Invertedyieldcurvemayindicatethatinterestratesareexpectedtofallandsignalarecession.

15-27Figure10.6TermSpread:Yieldson10-yearvs.90-dayTreasurySecurities

15-28ForwardRatesasForwardContractsIngeneral,forwardrateswillnotequaltheeventuallyrealizedshortrateStillanimportantconsiderationwhentryingtomakedecisions:Lockinginloanrates

15-29Figure10.7EngineeringaSyntheticForwardLoan

您可能关注的文档

- 商业银行管理全套配套课件英文PPT教师手册习题习题答案 Chap016.ppt

- 商业银行管理全套配套课件英文PPT教师手册习题习题答案 Chap013.ppt

- 商业银行管理全套配套课件英文PPT教师手册习题习题答案 Chap011.ppt

- 商业银行管理全套配套课件英文PPT教师手册习题习题答案 Chap009.ppt

- 商业银行管理全套配套课件英文PPT教师手册习题习题答案 Chap007.ppt

- 投资学,9e,精要版,48772,48760,英文PPT Chap006.ppt

- 投资学,9e,精要版,48772,48760,英文PPT Chap007.ppt

- 投资学,9e,精要版,48772,48760,英文PPT Chap002.ppt

- 投资学,9e,精要版,48772,48760,英文PPT Chap015.ppt

- 投资学,9e,精要版,48772,48760,英文PPT Chap013.ppt

- 投资学,9e,精要版,48772,48760,英文PPT Chap009.ppt

- 投资学,9e,精要版,48772,48760,英文PPT Chap011.ppt

- 投资学,9e,精要版,48772,48760,英文PPT Chap005.ppt

- 英文PPT演讲常用语.doc

- 商业银行管理全套配套课件英文PPT教师手册习题习题答案 Chap010.ppt

- 商业银行管理全套配套课件英文PPT教师手册习题习题答案 Chap002.ppt

- 商业银行管理全套配套课件英文PPT教师手册习题习题答案 Chap004.ppt

- 商业银行管理全套配套课件英文PPT教师手册习题习题答案 Chap019.ppt