- 627.50 KB

- 2022-05-26 16:46:07 发布

- 1、本文档共5页,可阅读全部内容。

- 2、本文档内容版权归属内容提供方,所产生的收益全部归内容提供方所有。如果您对本文有版权争议,可选择认领,认领后既往收益都归您。

- 3、本文档由用户上传,本站不保证质量和数量令人满意,可能有诸多瑕疵,付费之前,请仔细先通过免费阅读内容等途径辨别内容交易风险。如存在严重挂羊头卖狗肉之情形,可联系本站下载客服投诉处理。

- 文档侵权举报电话:19940600175。

CHAPTER6TheCapitalAssetPricingModel

9-2ItistheequilibriummodelthatunderliesallmodernfinancialtheoryDerivedusingprinciplesofdiversificationwithsimplifiedassumptionsMarkowitz,Sharpe,LintnerandMossinareresearcherscreditedwithitsdevelopmentCapitalAssetPricingModel(CAPM)

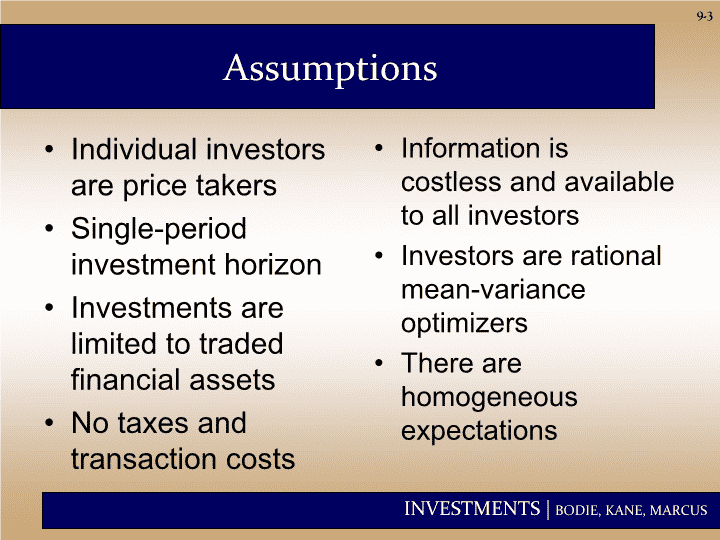

9-3AssumptionsIndividualinvestorsarepricetakersSingle-periodinvestmenthorizonInvestmentsarelimitedtotradedfinancialassetsNotaxesandtransactioncostsInformationiscostlessandavailabletoallinvestorsInvestorsarerationalmean-varianceoptimizersTherearehomogeneousexpectations

9-4Allinvestorswillholdthesameportfolioforriskyassets–marketportfolioMarketportfoliocontainsallsecuritiesandtheproportionofeachsecurityisitsmarketvalueasapercentageoftotalmarketvalueResultingEquilibriumConditions

9-5RiskpremiumonthemarketdependsontheaverageriskaversionofallmarketparticipantsRiskpremiumonanindividualsecurityisafunctionofitscovariancewiththemarketResultingEquilibriumConditions

9-6Figure6.1TheEfficientFrontierandtheCapitalMarketLine

9-7MarketRiskPremiumTheriskpremiumonthemarketportfoliowillbeproportionaltoitsriskandthedegreeofriskaversionoftheinvestor:

9-8Theriskpremiumonindividualsecuritiesisafunctionoftheindividualsecurity’scontributiontotheriskofthemarketportfolio.Anindividualsecurity’sriskpremiumisafunctionofthecovarianceofreturnswiththeassetsthatmakeupthemarketportfolio.ReturnandRiskForIndividualSecurities

9-9GEExampleCovarianceofGEreturnwiththemarketportfolio:Therefore,thereward-to-riskratioforinvestmentsinGEwouldbe:

9-10GEExampleReward-to-riskratioforinvestmentinmarketportfolio:Reward-to-riskratiosofGEandthemarketportfolioshouldbeequal:

9-11GEExampleTheriskpremiumforGE:Restating,weobtain:

9-12ExpectedReturn-BetaRelationshipCAPMholdsfortheoverallportfoliobecause:Thisalsoholdsforthemarketportfolio:

9-13Figure6.2TheSecurityMarketLine

9-14Figure6.3TheSMLandaPositive-AlphaStock

9-15TheIndexModelandRealizedReturnsTomovefromexpectedtorealizedreturns,usetheindexmodelinexcessreturnform:TheindexmodelbetacoefficientisthesameasthebetaoftheCAPMexpectedreturn-betarelationship.

9-16Figure6.4EstimatesofIndividualMutualFundAlphas,1972-1991

9-17IstheCAPMPractical?CAPMisthebestmodeltoexplainreturnsonriskyassets.Thismeans:Withoutsecurityanalysis,αisassumedtobezero.Positiveandnegativealphasarerevealedonlybysuperiorsecurityanalysis.

9-18IstheCAPMPractical?Wemustuseaproxyforthemarketportfolio.CAPMisstillconsideredthebestavailabledescriptionofsecuritypricingandiswidelyaccepted.

9-19EconometricsandtheExpectedReturn-BetaRelationshipStatisticalbiasiseasilyintroduced.MillerandScholespaperdemonstratedhoweconometricproblemscouldleadonetorejecttheCAPMevenifitwereperfectlyvalid.

9-20ExtensionsoftheCAPMZero-BetaModelHelpstoexplainpositivealphasonlowbetastocksandnegativealphasonhighbetastocksConsiderationoflaborincomeandnon-tradedassets

9-21ExtensionsoftheCAPMMerton’sMultiperiodModelandhedgeportfoliosIncorporationoftheeffectsofchangesintherealrateofinterestandinflationConsumption-basedCAPMRubinstein,Lucas,andBreedenInvestorsallocatewealthbetweenconsumptiontodayandinvestmentforthefuture

9-22LiquidityandtheCAPMLiquidity:TheeaseandspeedwithwhichanassetcanbesoldatfairmarketvalueIlliquidityPremium:Discountfromfairmarketvaluethesellermustaccepttoobtainaquicksale.Measuredpartlybybid-askedspreadAstradingcostsarehigher,theilliquiditydiscountwillbegreater.

9-23Figure6.5TheRelationshipBetweenIlliquidityandAverageReturns

9-24LiquidityRiskInafinancialcrisis,liquiditycanunexpectedlydryup.Whenliquidityinonestockdecreases,ittendstodecreaseinotherstocksatthesametime.InvestorsdemandcompensationforliquidityriskLiquiditybetas

您可能关注的文档

- 当代市场调研10E全套配套课件中英文PPTch04.ppt

- 计算机科学概论原书第5版制作 中英文PPT教师手册习题等65739_PPTx_Chapter08.ppt

- 日本拉面 英文PPT.ppt

- 成都美食英文PPT.ppt

- 商业银行管理全套配套课件英文PPT教师手册习题习题答案 Chap016.ppt

- 商业银行管理全套配套课件英文PPT教师手册习题习题答案 Chap013.ppt

- 商业银行管理全套配套课件英文PPT教师手册习题习题答案 Chap011.ppt

- 商业银行管理全套配套课件英文PPT教师手册习题习题答案 Chap009.ppt

- 商业银行管理全套配套课件英文PPT教师手册习题习题答案 Chap007.ppt

- 投资学,9e,精要版,48772,48760,英文PPT Chap007.ppt

- 投资学,9e,精要版,48772,48760,英文PPT Chap002.ppt

- 投资学,9e,精要版,48772,48760,英文PPT Chap015.ppt

- 投资学,9e,精要版,48772,48760,英文PPT Chap010.ppt

- 投资学,9e,精要版,48772,48760,英文PPT Chap013.ppt

- 投资学,9e,精要版,48772,48760,英文PPT Chap009.ppt

- 投资学,9e,精要版,48772,48760,英文PPT Chap011.ppt

- 投资学,9e,精要版,48772,48760,英文PPT Chap005.ppt

- 英文PPT演讲常用语.doc